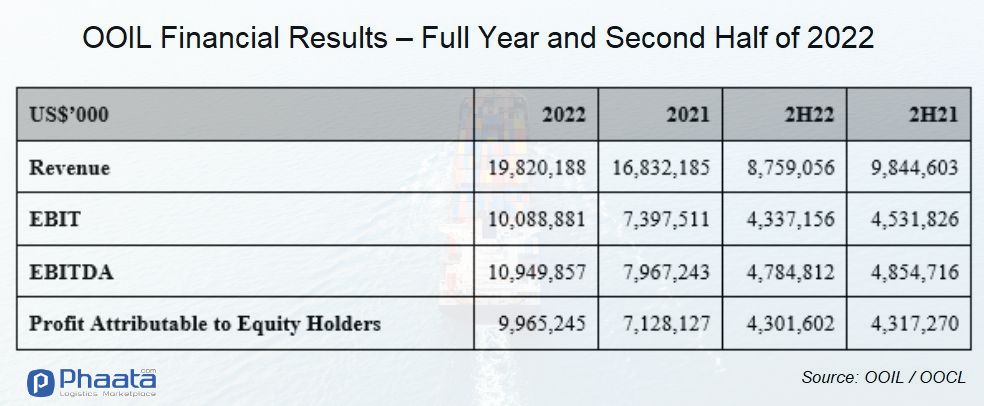

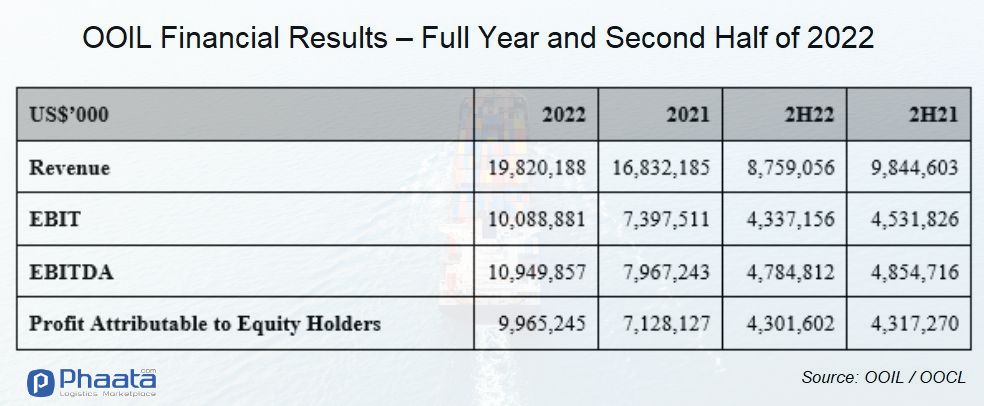

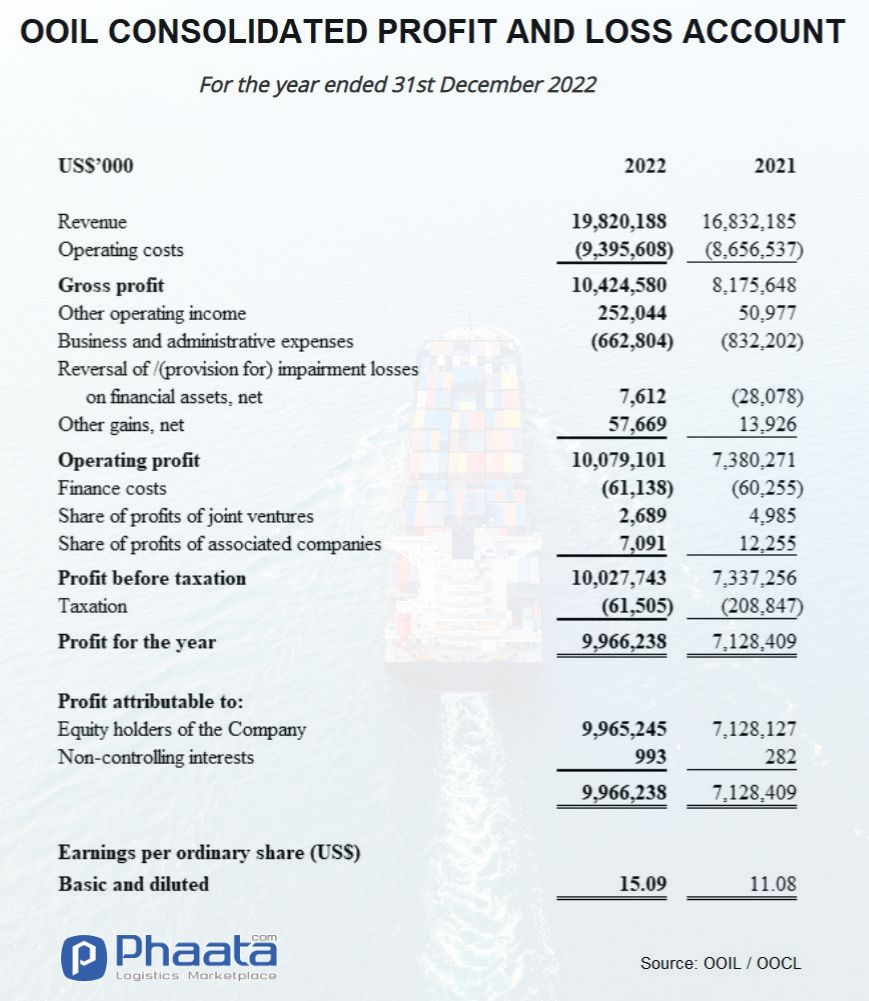

Orient Overseas (International) Limited, the parent company of shipping line OOCL, has announced its full-year business results for 2022, with revenue of 19.82 billion USD and profit before interest and tax (EBIT) of 10,089 billion USD.

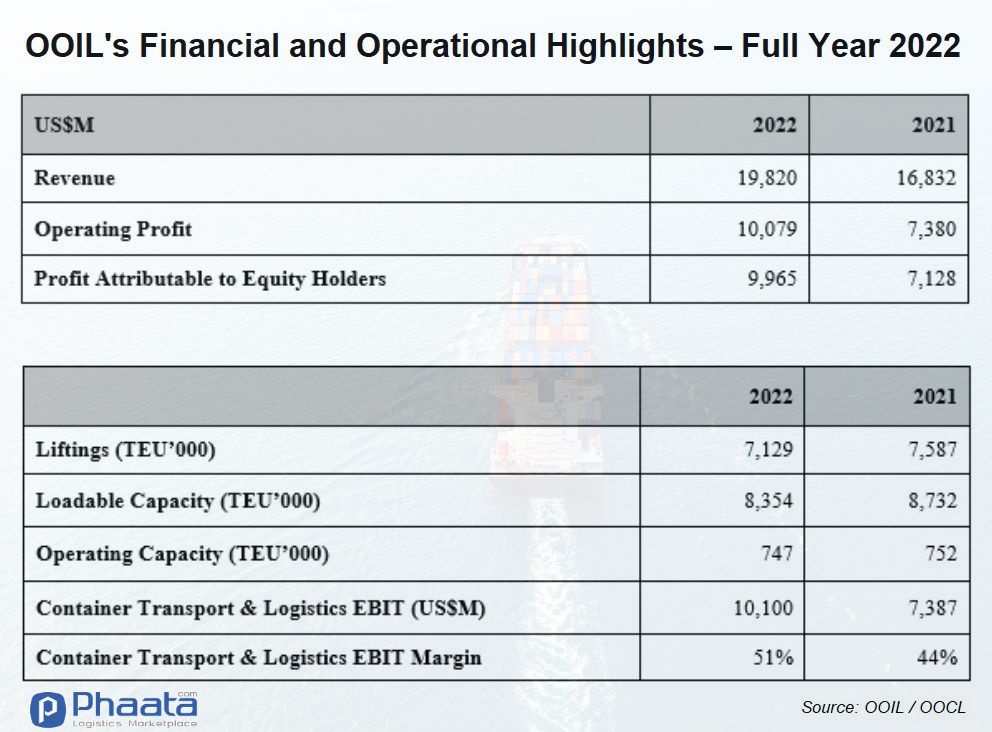

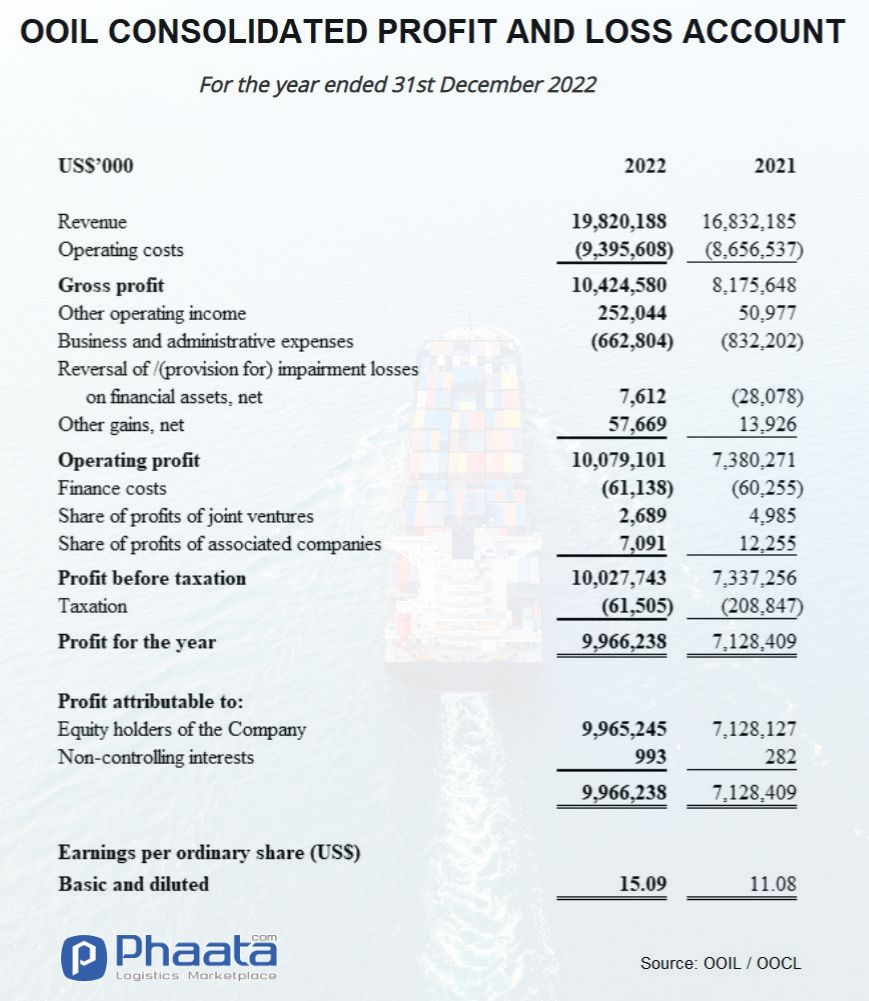

Orient Overseas (International) Limited (OOIL), the parent company of OOCL (Orient Overseas Container Line) announced its full-year business results for 2022, reporting revenue of $19.82 billion.

In addition, the company's profit before interest and tax (EBIT) increased to $10.089 billion, while profit before interest, tax and amortization (EBITDA) reached $10.95 billion.

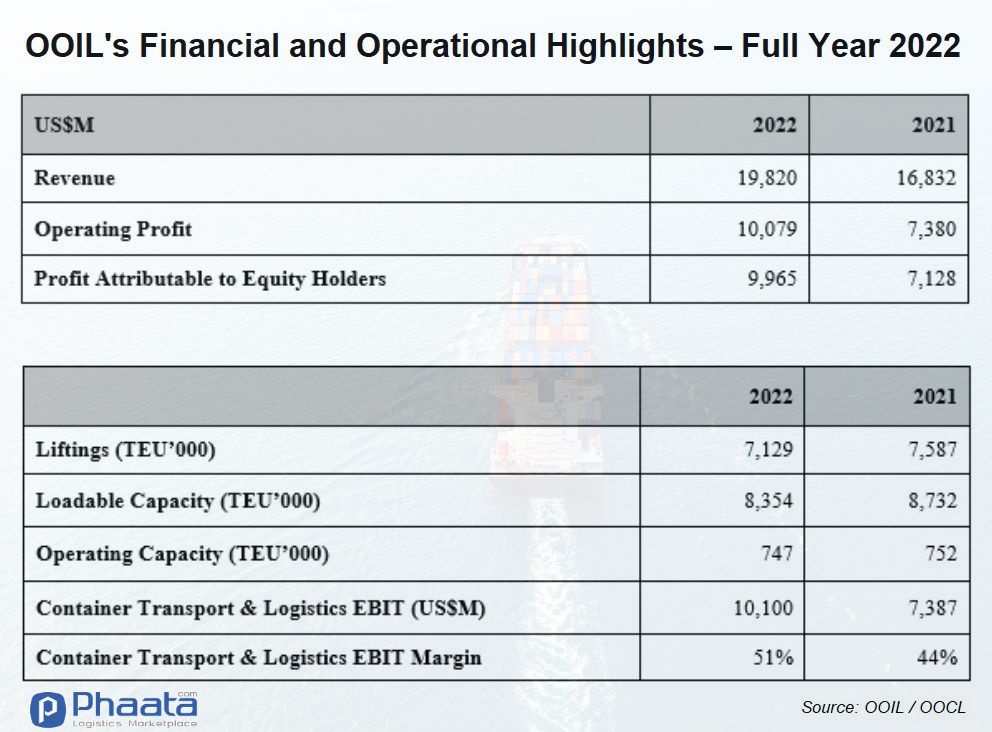

In 2022, OOCL shipped 7.1 million TEUs, down about 450,000 TEUs from 2021.

Along with that, the profit allocated to shareholders for 2022 is $ 9,965 billion. Earnings per common share for 2022 were $15.09, compared with $11.08 for 2021.

“Partnering with members of the COSCO SHIPPING Group continues to deliver significant benefits in terms of efficiency, cost savings and our ability to serve our customers with global reach,” said OOIL. We continue to evaluate ways to strengthen and deepen our partnership, with a win-win approach that will benefit our customers, employees, business partners and shareholders."

According to the report, in 2023 and 2024, supply will increase further through the delivery of new vessels – which could slow any improvement in the container shipping market, even if the economic situation more favorable than expected.

Although there will be a few solutions to reduce the risk of increasing supply, such as through increasing the number of ships being unloaded, and more importantly from new environmental regulations. But these will take time to see an impact and therefore won't bring much of a balance until the first half of 2023 at the earliest. At the same time, in the first half of the year, it is possible that the shipping companies will see assess the expected level of demand and adjust their services accordingly.

As of December 31, 2022, the Group had a cash and bank balance of USD 11.214 billion against debt obligations of USD 712.2 million payable in 2023.

OOIL owns one of the world's leading international integrated container shipping enterprises with the trading name "OOCL". Having about 440 offices in about 90 countries/regions, the Group is one of the international enterprises. OOIL is listed on the Hong Kong Stock Exchange.